In Brazil, the electronic payment system 'Pix' introduced by the government has become explosively popular.

In November 2020, when the COVID-19 pandemic was raging, the Brazilian government introduced Pix, a digital payment system that allows quick payments without physical contact. The economic newspaper The Economist summarizes the current status of Pix's adoption and future prospects.

Brazil's government-run payments system has become dominant

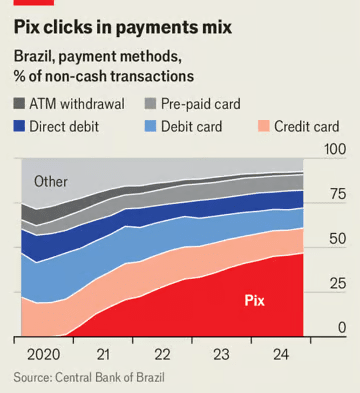

Below is a graph created by The Economist based on data from the Brazilian Central Bank showing the breakdown of payment methods in Brazil. By 2024, Pix, shown in red, had surpassed cash and credit cards to become the most popular payment method in Brazil, with 63 billion transactions and a value of 26 trillion reals (about 640 trillion yen).

Introduced by the Brazilian government, Pix is free for consumers and comes with a very low fee of 0.22% for retailers, one-tenth of what banks were charging retailers to process card payments, forcing banks to lower their fees.

Until 2018, six banks controlled 82% of assets and 86% of loans in Brazil, but Pix has made it easier for small and medium-sized businesses that cannot afford to set up large numbers of branches or ATMs to enter the financial market.

A similar initiative was launched in India in 2016 with the launch of its Unified Payments Interface (UPI). The free service, which can be accessed by simply scanning a QR code, has proved a success, helping to turn India into one of the world's leading electronic payments powers.

How India transformed into an electronic payments powerhouse? - GIGAZINE

by Atul Loke for The New York Times

Pix has penetrated the Brazilian economy more quickly than India's UPI and CoDi, a similar electronic payment system introduced by the Mexican government in 2019, and other countries are following Brazil's lead. For example, in February 2025, Colombia announced the launch of Bre-B , a new instant payment system developed in partnership with a fintech company involved in the development of Pix.

However, unlike UPI, which is run by an industry group, Pix is fully controlled by the Brazilian Central Bank, raising concerns about the concentration of hacking risks and criticism of the centralized system.

'We are a democracy, but imagine if we were a dictatorship and the government had all of our citizens' data in its hands,' said the head of a prominent fintech company, speaking to The Economist on condition of anonymity.

In January 2025, the government announced that it would make it mandatory to disclose all Pix transactions above a certain amount. This led to rumors that the government was 'preparing for a Pix tax,' which escalated into a major scandal and forced the government to retract the announcement. Pix's popularity means that bad news can quickly escalate into a major issue.

Despite these issues, Pix has expanded beyond Brazil to other South American countries, with payment processors in Latin America beginning to support Pix one after another. The Brazilian Central Bank is also in talks with countries with large Brazilian immigrant populations to allow remittances through Pix, which is expected to reduce the competitiveness of local remittance providers that charge high fees.

The popularity of Pix is also paving the way for the realization of Brazil's digital currency, Drex, and the Central Bank of Brazil has begun piloting Drex in partnership with Visa, Mastercard, Google and others.

In a thread on the social news site Hacker News that discussed this article, a Hacker News user who has lived in Brazil for many years wrote, 'Pix has revolutionized the way we transact in Brazil. I use it for small change payments, and my friends have bought houses with it. Pix works for any amount without any problems and is very easy to use. Its speed and reliability are amazing, and I have never had a Pix payment fail due to downtime. When I withdraw money to my Brazilian account with Wise , I get a push notification from my Brazilian bank before the Wise confirmation screen animation is over. It's like magic. Today in Brazil, Pix is so widespread that I don't even care who is using it anymore. Taxi drivers and even homeless people ask for Pix instead of coins. There's no way cryptocurrency will win.'

Related Posts:

in Web Service, Posted by log1l_ks