What can we learn from stock market crashes over the past 150 years?

The stock market can experience a 'crash' in which stock prices suddenly and dramatically fall across the board. Morningstar, an investment information service company, looked back at the major crashes of the past 150 years and summarized what lessons they can teach us about predicting the impact of the market turmoil that occurred in March 2025.

Stock Market Crashes: A Look at 150 Years of Bear Markets | Morningstar

https://www.morningstar.com/economy/what-weve-learned-150-years-stock-market-crashes

Since 2020 alone, stock prices have crashed for a variety of reasons, including the COVID-19 pandemic, the war between Russia and Ukraine, inflation, and supply shortages. Regarding these crashes, Morningstar said that while it is 'impossible to predict how long it will take for the stock market to recover,' it also said that 'if you don't rush to sell your stock holdings, you will be rewarded in the long run,' and that 'these lessons apply not only to recent crashes, but also to crashes over the past 150 years or more.'

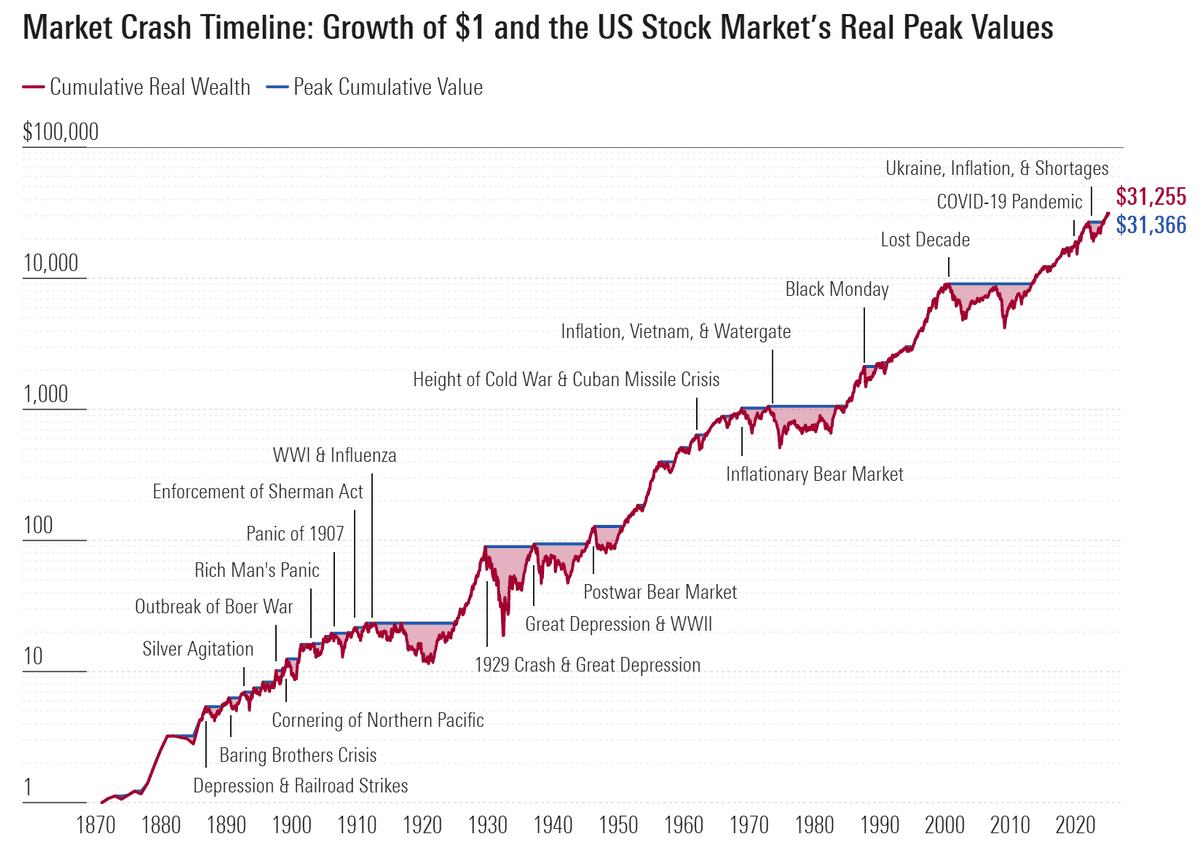

Although it depends on how you define a 'great crash,' there have been 19 major crashes in the 154 years from 1871 to 2025. The chart below shows the inflation-adjusted asset trends for a $1 investment in 1871, with the red line representing cumulative assets and the blue line representing the highest point of cumulative assets.

The graph above shows that long-term investments have generated huge profits, but there have also been many market crashes during this period.

The Great Crash of 1929

During the Great Crash of October 1929, stock prices fell by 79% during that period, the largest drop in 154 years.

・The Lost Decade

The dot-com bubble burst around 2000, ushering in a period of recession known as the lost decade. It was only in May 2013, 12 years after the first crash, that stock prices finally recovered to their original levels. Throughout the entire period, the largest drop in stock prices was 54%.

- Inflation, Vietnam, Watergate

Around 1973, a combination of factors including the Vietnam War, the Watergate Scandal, and the oil crisis caused stock prices to fall by as much as 51.9%.

People tend to think of market crashes as 'emergencies,' but in reality they are regular events that occur about once every 10 years.

Stock prices are subject to

volatility

, or price fluctuations, but they tend to rise over the long term. Even in past major crashes, the market has ultimately been successful in recovering. However, since it is not clear how long it will take for the market to recover, Morningstar states that 'it is important to have a well-diversified portfolio that is appropriate for your time horizon and risk tolerance,' and concludes the article by saying, 'Investors who continue to invest in the market for the long term should reap the benefits that are commensurate with the turmoil.'Related Posts:

in Note, Posted by log1d_ts